A Fixer's Paradise: Why the US is Rolling Out Red Carpet for Prediction Markets

The NCAA asked the US government to suspend all prediction markets for college sports, warning of the risk of insider trading and match-fixing. The exact opposite happened.

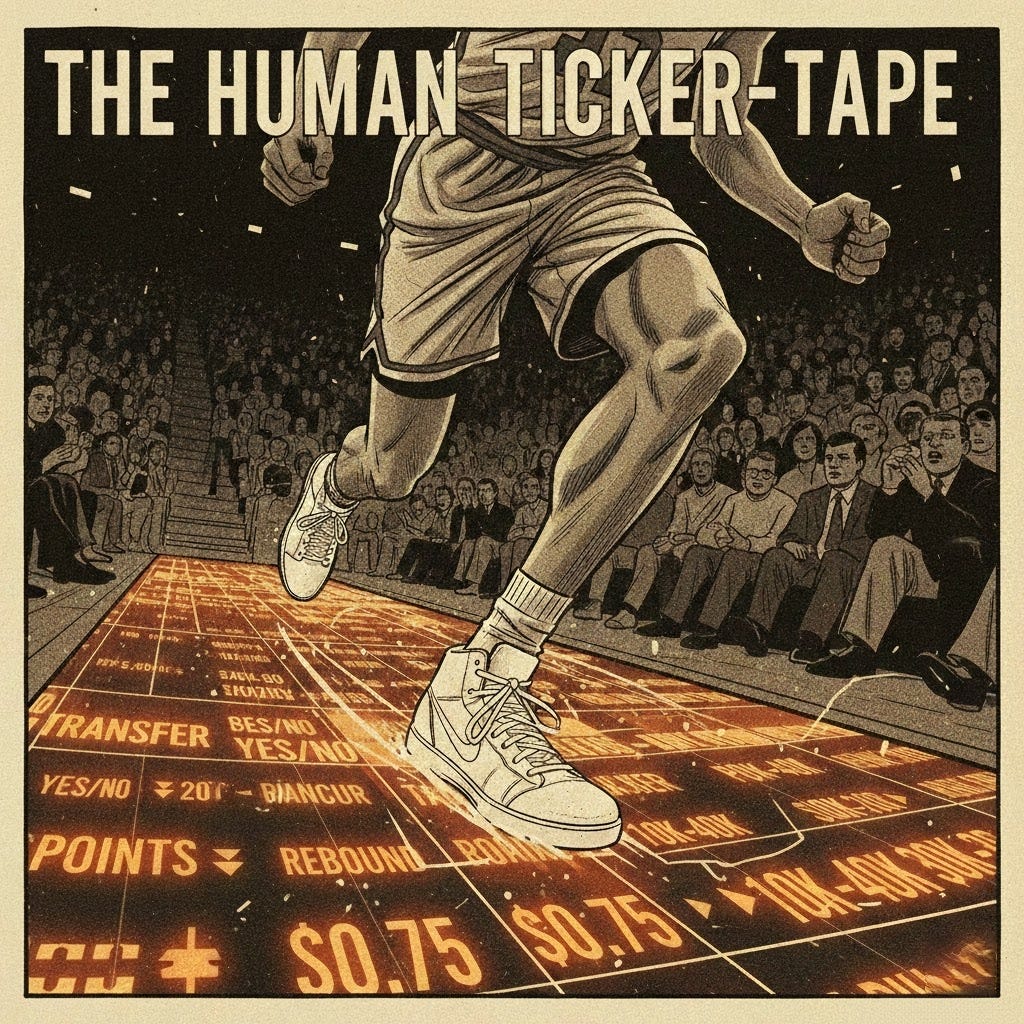

On January 15, federal prosecutors in Philadelphia unsealed a landmark indictment: 26 people charged in an international point-shaving ring that bribed 39 college basketball players across 17 schools to fix or attempt 29 games from 2022 to 2025.

The fixers were former NBA players like Jalen Smith and Antonio Blakeney. They targeted mid-tier colleges like DePaul, Kennesaw State, Tulane, offering players cash bribes of $10,000-40,000, easily dwarfing the earnings these players would get from NIL (name, image and likeness).

The indictment came just 24 hours after Charlie Baker, the president of the National Collegiate Athletic Association (NCAA), wrote a damning letter to the Commodity Futures Trading Commission (CFTC), the government agency regulating the US derivatives market.

Baker demanded that the CFTC issue a full suspension of collegiate prediction markets. This is due to platforms like Kalshi and Polymarket treating matching outcomes as tradable commodities. These exchanges allow users to buy "yes/no" contracts on events like point spreads, with prices fluctuating widely based on market probability.